Average student loan debt costs approximately $500,000 in lost retirement savings

A recent study the Center for Retirement Research at Boston College found that having the average student loan amount would cause retirement insecurity to rise by more than 5% percentage points. This level of retirement insecurity is similar in magnitude to an across-the-board cut of nearly 20% to future Social Security benefits, the study reveals.

What’s more, with the future of Social Security up for debate, saving for retirement is even more important for recent college graduates who may not be able to count on the same level of benefits as earlier generations. With many graduates choosing to save less for retirement while they pay their student loans, GoodCall’s analysis reveals that this could come at a much bigger cost than the student loans themselves, amounting to hundreds of thousands of dollars in lost retirement savings and forcing a retirement age well beyond age 65 for many debt-laden college graduates.

Key findings for retirement savings

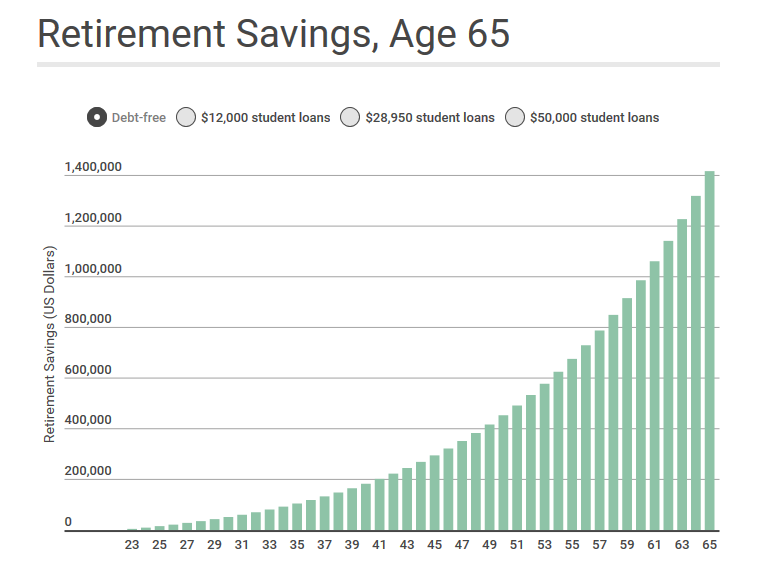

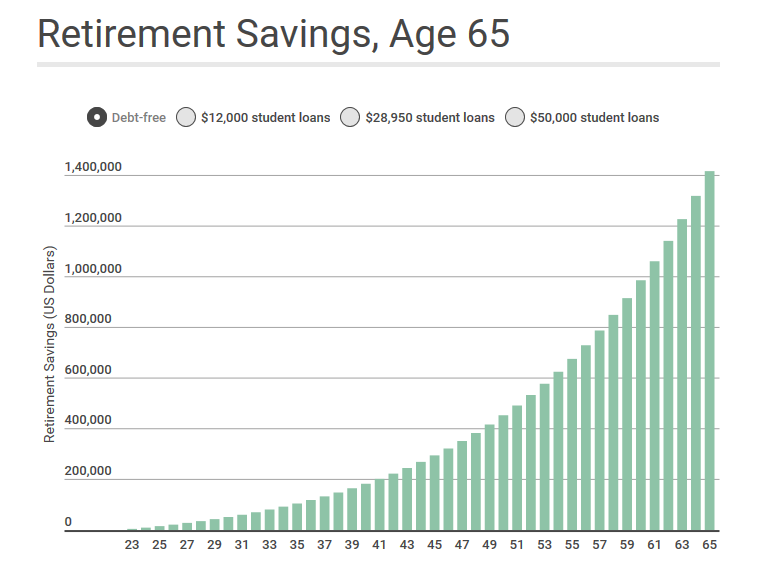

Having $28,950 in student loans costs nearly the same as having $50,000 in student loans when it comes to lost retirement savings, with graduates at both student debt levels having approximately half a million dollars less in retirement savings compared to debt-free graduates.

Saving at a higher rate, like 10% or 20% of income, significantly narrows the gap in retirement savings between graduates with student debt and those who are debt-free.

Extending loan repayment terms to 20 or 25 years on larger student debt loads has a more damaging impact on retirement savings. Compared to debt-free graduates, graduates with $50,000 in student loans on a 25-year repayment plan will have close to one million dollars less in retirement savings.

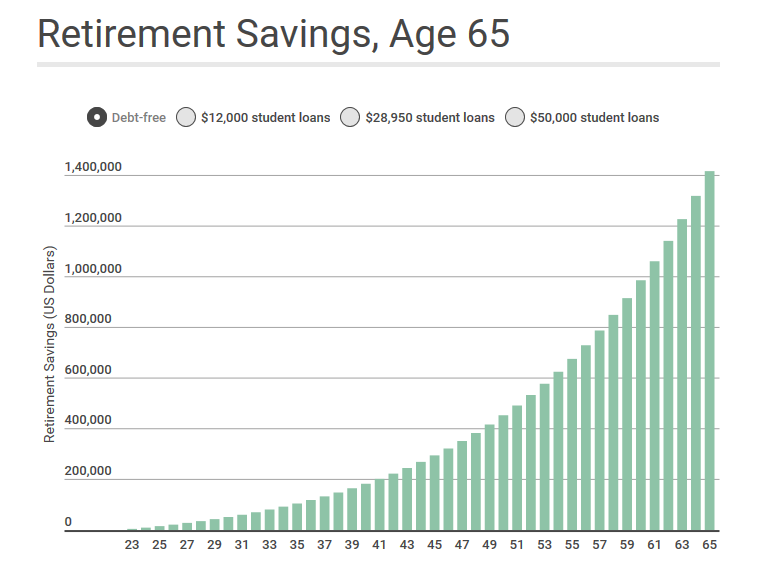

By age 65, a debt-free graduate will have more than $1.4 million in retirement savings, based on savings 6% of total income and an employer 401(K) match of 3%. In comparison, a graduate with student loan debt of $50,000 can expect to have just under $908,000, a difference of more than half a million dollars. What’s even more striking is that a graduate with $28,950 will have just over $911,000 in retirement savings, a difference that also hovers around $500,000.

Choosing to save less for retirement during the first ten years of work, in order to make monthly student loan payments, can mean debts of $28,950 or $50,000 both end up costing over $500,000 from repayment to retirement. read full article

Retirement

A recent study the Center for Retirement Research at Boston College found that having the average student loan amount would cause retirement insecurity to rise by more than 5% percentage points. This level of retirement insecurity is similar in magnitude to an across-the-board cut of nearly 20% to future Social Security benefits, the study reveals.

What’s more, with the future of Social Security up for debate, saving for retirement is even more important for recent college graduates who may not be able to count on the same level of benefits as earlier generations. With many graduates choosing to save less for retirement while they pay their student loans, GoodCall’s analysis reveals that this could come at a much bigger cost than the student loans themselves, amounting to hundreds of thousands of dollars in lost retirement savings and forcing a retirement age well beyond age 65 for many debt-laden college graduates.

Key findings for retirement savings

Having $28,950 in student loans costs nearly the same as having $50,000 in student loans when it comes to lost retirement savings, with graduates at both student debt levels having approximately half a million dollars less in retirement savings compared to debt-free graduates.

Saving at a higher rate, like 10% or 20% of income, significantly narrows the gap in retirement savings between graduates with student debt and those who are debt-free.

Extending loan repayment terms to 20 or 25 years on larger student debt loads has a more damaging impact on retirement savings. Compared to debt-free graduates, graduates with $50,000 in student loans on a 25-year repayment plan will have close to one million dollars less in retirement savings.

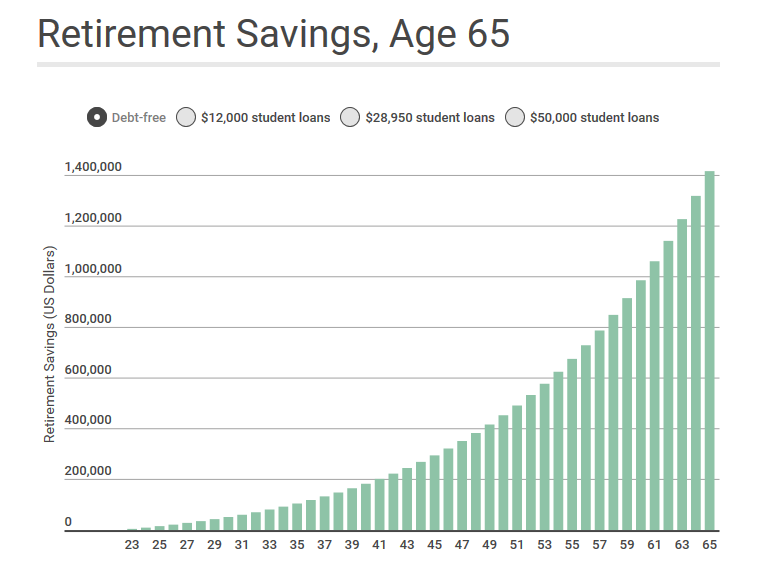

By age 65, a debt-free graduate will have more than $1.4 million in retirement savings, based on savings 6% of total income and an employer 401(K) match of 3%. In comparison, a graduate with student loan debt of $50,000 can expect to have just under $908,000, a difference of more than half a million dollars. What’s even more striking is that a graduate with $28,950 will have just over $911,000 in retirement savings, a difference that also hovers around $500,000.

Choosing to save less for retirement during the first ten years of work, in order to make monthly student loan payments, can mean debts of $28,950 or $50,000 both end up costing over $500,000 from repayment to retirement.

Retirement

A recent study the Center for Retirement Research at Boston College found that having the average student loan amount would cause retirement insecurity to rise by more than 5% percentage points. This level of retirement insecurity is similar in magnitude to an across-the-board cut of nearly 20% to future Social Security benefits, the study reveals.

What’s more, with the future of Social Security up for debate, saving for retirement is even more important for recent college graduates who may not be able to count on the same level of benefits as earlier generations. With many graduates choosing to save less for retirement while they pay their student loans, GoodCall’s analysis reveals that this could come at a much bigger cost than the student loans themselves, amounting to hundreds of thousands of dollars in lost retirement savings and forcing a retirement age well beyond age 65 for many debt-laden college graduates.

Key findings for retirement savings

Having $28,950 in student loans costs nearly the same as having $50,000 in student loans when it comes to lost retirement savings, with graduates at both student debt levels having approximately half a million dollars less in retirement savings compared to debt-free graduates.

Saving at a higher rate, like 10% or 20% of income, significantly narrows the gap in retirement savings between graduates with student debt and those who are debt-free.

Extending loan repayment terms to 20 or 25 years on larger student debt loads has a more damaging impact on retirement savings. Compared to debt-free graduates, graduates with $50,000 in student loans on a 25-year repayment plan will have close to one million dollars less in retirement savings.

By age 65, a debt-free graduate will have more than $1.4 million in retirement savings, based on savings 6% of total income and an employer 401(K) match of 3%. In comparison, a graduate with student loan debt of $50,000 can expect to have just under $908,000, a difference of more than half a million dollars. What’s even more striking is that a graduate with $28,950 will have just over $911,000 in retirement savings, a difference that also hovers around $500,000.

Choosing to save less for retirement during the first ten years of work, in order to make monthly student loan payments, can mean debts of $28,950 or $50,000 both end up costing over $500,000 from repayment to retirement.

Retirement

A recent study the Center for Retirement Research at Boston College found that having the average student loan amount would cause retirement insecurity to rise by more than 5% percentage points. This level of retirement insecurity is similar in magnitude to an across-the-board cut of nearly 20% to future Social Security benefits, the study reveals.

What’s more, with the future of Social Security up for debate, saving for retirement is even more important for recent college graduates who may not be able to count on the same level of benefits as earlier generations. With many graduates choosing to save less for retirement while they pay their student loans, GoodCall’s analysis reveals that this could come at a much bigger cost than the student loans themselves, amounting to hundreds of thousands of dollars in lost retirement savings and forcing a retirement age well beyond age 65 for many debt-laden college graduates.

Key findings for retirement savings

Having $28,950 in student loans costs nearly the same as having $50,000 in student loans when it comes to lost retirement savings, with graduates at both student debt levels having approximately half a million dollars less in retirement savings compared to debt-free graduates.

Saving at a higher rate, like 10% or 20% of income, significantly narrows the gap in retirement savings between graduates with student debt and those who are debt-free.

Extending loan repayment terms to 20 or 25 years on larger student debt loads has a more damaging impact on retirement savings. Compared to debt-free graduates, graduates with $50,000 in student loans on a 25-year repayment plan will have close to one million dollars less in retirement savings.

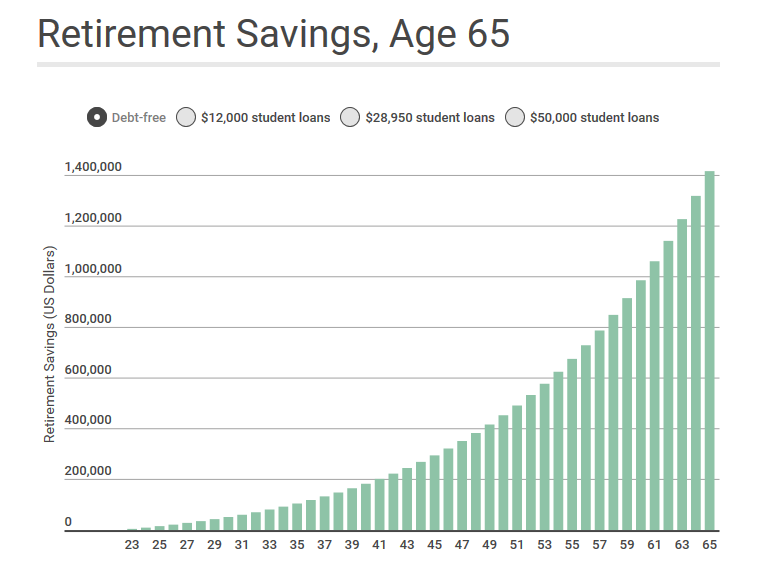

By age 65, a debt-free graduate will have more than $1.4 million in retirement savings, based on savings 6% of total income and an employer 401(K) match of 3%. In comparison, a graduate with student loan debt of $50,000 can expect to have just under $908,000, a difference of more than half a million dollars. What’s even more striking is that a graduate with $28,950 will have just over $911,000 in retirement savings, a difference that also hovers around $500,000.

Choosing to save less for retirement during the first ten years of work, in order to make monthly student loan payments, can mean debts of $28,950 or $50,000 both end up costing over $500,000 from repayment to retirement.

Retirement

A recent study the Center for Retirement Research at Boston College found that having the average student loan amount would cause retirement insecurity to rise by more than 5% percentage points. This level of retirement insecurity is similar in magnitude to an across-the-board cut of nearly 20% to future Social Security benefits, the study reveals.

What’s more, with the future of Social Security up for debate, saving for retirement is even more important for recent college graduates who may not be able to count on the same level of benefits as earlier generations. With many graduates choosing to save less for retirement while they pay their student loans, GoodCall’s analysis reveals that this could come at a much bigger cost than the student loans themselves, amounting to hundreds of thousands of dollars in lost retirement savings and forcing a retirement age well beyond age 65 for many debt-laden college graduates.

Key findings for retirement savings

Having $28,950 in student loans costs nearly the same as having $50,000 in student loans when it comes to lost retirement savings, with graduates at both student debt levels having approximately half a million dollars less in retirement savings compared to debt-free graduates.

Saving at a higher rate, like 10% or 20% of income, significantly narrows the gap in retirement savings between graduates with student debt and those who are debt-free.

Extending loan repayment terms to 20 or 25 years on larger student debt loads has a more damaging impact on retirement savings. Compared to debt-free graduates, graduates with $50,000 in student loans on a 25-year repayment plan will have close to one million dollars less in retirement savings.

By age 65, a debt-free graduate will have more than $1.4 million in retirement savings, based on savings 6% of total income and an employer 401(K) match of 3%. In comparison, a graduate with student loan debt of $50,000 can expect to have just under $908,000, a difference of more than half a million dollars. What’s even more striking is that a graduate with $28,950 will have just over $911,000 in retirement savings, a difference that also hovers around $500,000.

Choosing to save less for retirement during the first ten years of work, in order to make monthly student loan payments, can mean debts of $28,950 or $50,000 both end up costing over $500,000 from repayment to retirement. read full article

Retirement