Return on Sales: How to Calculate It and What You Need to Know

Return on Sales: How to Calculate It and What You Need to Know

Return on sales is one of the most important metrics involved in gauging the health of your business and testing the logic behind your sales strategies and budget. The figure is reported as a ratio and shows how much of your overall revenue results in profit versus paying down operating costs.

Over time, you want your ROS to go up, because a higher ratio means more profit. Your ROS is an important data point for your company to track, so let’s jump into how you can calculate return on sales for your business and what the figure is used for.

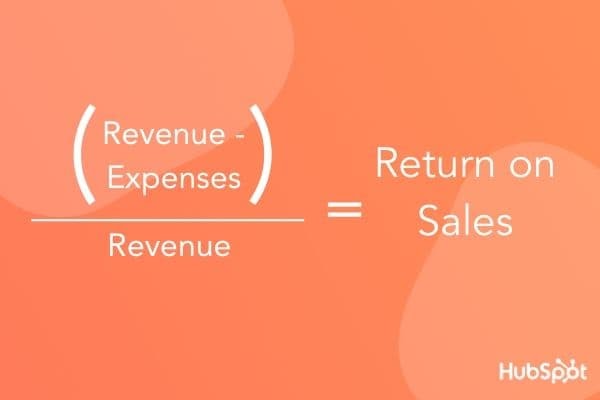

How to Calculate Return on Sales

Return on sales is calculated by dividing your business’s operating profit by your net revenue from sales. For instance, let’s say your business had $500,000 in sales and $400,000 in expenses this past quarter.

If you wanted to calculate your return on sales, you would first determine your profit by subtracting your expense figure from your revenue. In this example, you’d have $100,000 in profit.You would then divide that profit figure by your total revenue of $500,000 — giving you a ROS of .20.

ROS is typically reported as a percentage; so in most cases, you would be expected multiply that final number by 100 and use that to report your ROS — in this case, it would be 20%.

That percentage represents how many cents you make in profit for every dollar you earn in sales. Here, your ROS would be 20 cents per dollar.

Why Is Return on Sales Important?

Return on sales is one of the most straightforward figures for determining a company’s overall performance. Stakeholders and creditors are often interested in the metric because it provides an accurate overview of a company’s reinvestment potential, ability to pay back loans, and potential dividends.

ROS is also one of the more reliable figures for measuring year over year performance. A company’s revenue and expenses could vary over time, so higher revenue might not be the most accurate metric of a company’s profitability.

Return on sales, on the other hand, is a measure of both revenue and expenses. It allows businesses to identify how both figures are interacting and can give a much more accurate picture of how well the company is actually performing.

It can also be used to compare the success of different companies. That being said, ROS varies greatly from industry to industry. If you’re using it to compare two businesses, the comparison would generally only be fair if those companies were in the same space.

Return on Sales vs. Profit Margin

The terms “return on sales” and “profit margin” are often used interchangeably, but those semantics are only partially accurate. There are different kinds of profit margins — only one of which is the same as return on sales.

Net profit margin

Net profit margin is a ratio that compares net profits and sales. You can calculate this figure by dividing a company’s net profit after taxes and total net value of sales. If your company had profits of $150,000 after taxes and net sales of $100,000, you would have a net profit margin of 1.5 or 150%.

Net profit margin is a metric that helps companies compare how they have performed over different time periods. Companies typically use this figure when looking over past performance.

Gross profit margin

You can calculate a business’s gross profit margin by subtracting the cost of all goods sold from the value of the sales and then dividing that figure by the value of sales. If you had sales of $50,000 and the cost of goods sold was $20,000, you would subtract $20,000 from $50,000 and divide the difference of $30,000 by the sales value of $50,000 — giving you a gross profit margin of .6 or 60%.

Gross profit margin is generally used as a benchmark for comparing different companies. It’s a good way to gauge how efficiently a specific company can generate profits relative to its competitors.

Operating profit margin

Operating profit margin is another term for return on sales. Use the ROS equation to find this figure.

Return on sales is an important metric with a variety of applications. As a business owner, it’s crucial that you have a picture of yours. If you want to know how efficiently you’re turning over profit, you should understand what ROS is and how to calculate it yourself.

![]()

Source: hubspot sales