Average student loan debt costs college graduates five extra years to homeownership

GoodCall’s analysis on the cost of student loans and home-buying finds that it takes graduates with the average student loan debt of $28,950 about 5 years longer to save a 20% home down payment. These graduates have almost $50,000 less in home equity 15 years after graduation compared to debt-free graduates.

Homeownership has fallen over the past decade. However, for college graduates with student loan debt, the downward trend is even more marked, according to research by the Federal Reserve Bank of New York. Though some argue that the verdict is still out on whether student loan debt impacts the rate of homeownership among college graduates, what is clear is that after college, graduates with student debt must use part of their income to pay down loans. This means less income is available for saving compared to debt-free graduates.

It also means that graduates with student loan debt will have to save at a higher rate than their debt-free counterparts to buy a home sooner. This points to another challenge student loan borrowers face: making tough decisions over whether to pay student loans off as quickly as possible or save for big purchases like a home.

In fact, a recent Harvard study reveals the consequences for wealth building that these difficult decisions can have over the long-term, where college-educated households with student loan debt were found to have significantly less in assets, cash savings, and net wealth compared to college-educated households without student loans.

Key findings for homebuying timeline

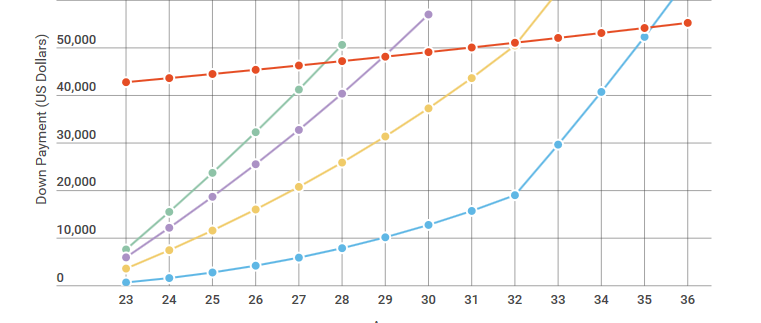

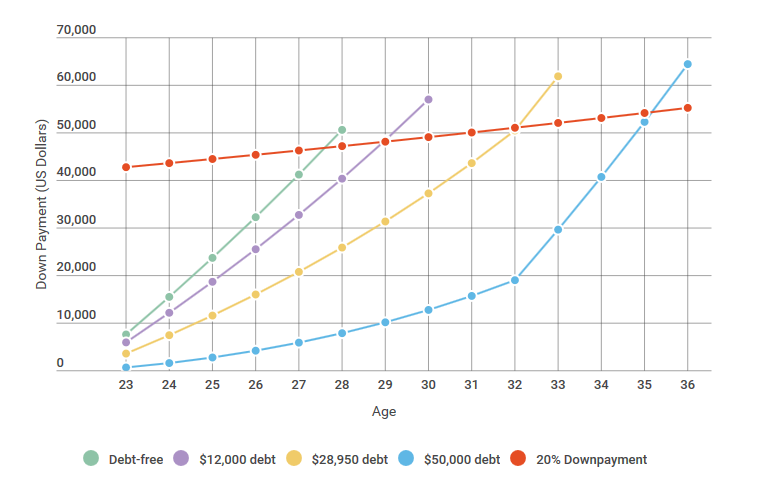

A 23-year-old debt-free college graduate today will be ready to buy a home with a 20% down payment in 2021 at age 28. That’s five years earlier than the 33-year-old

[3]

average home buyer today.

Graduates with $12,000 in student loan debt can expect to save until 2022 before they’re able to put a 20% down payment on a median price home.

A 23-year-old graduate with $28,950 in student loan debt today will be saving until 2026 before she can make a 20% down payment on a home, at age 33 – the current average age for home buying.

Graduates with $50,000 in student loans will be saving until age 36 in 2029 before they’ll have enough for a 20% home down payment.

Years Spend Saving for A 20% Home Down Payment

Years Spend Saving for A 20% Home Down Payment