GDT to Initiate Capital Gains Tax Collection from January 2021

The General Department of Taxation (GDT) of the Ministry of Economy and Finance will collect tax on capital gains from 01 January 2021, after delaying implementation since July 2020.

According to the Prakas of the Ministry of Economy and Finance, capital gains refers to taxable income from the sale or transfer of capital deducted with occurred expenses.

Capital refers to real estate, leasing, investment capital, business reputation, intellectual property, and foreign currencies.

The capital gains tax rate is to be set at a fixed rate of 20%.

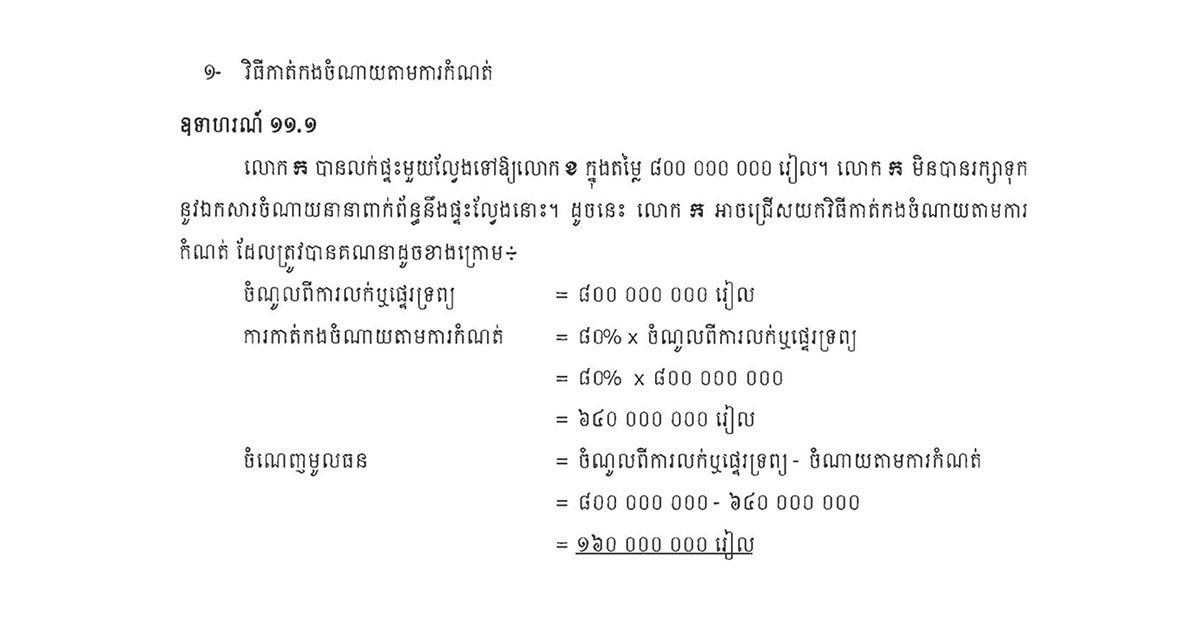

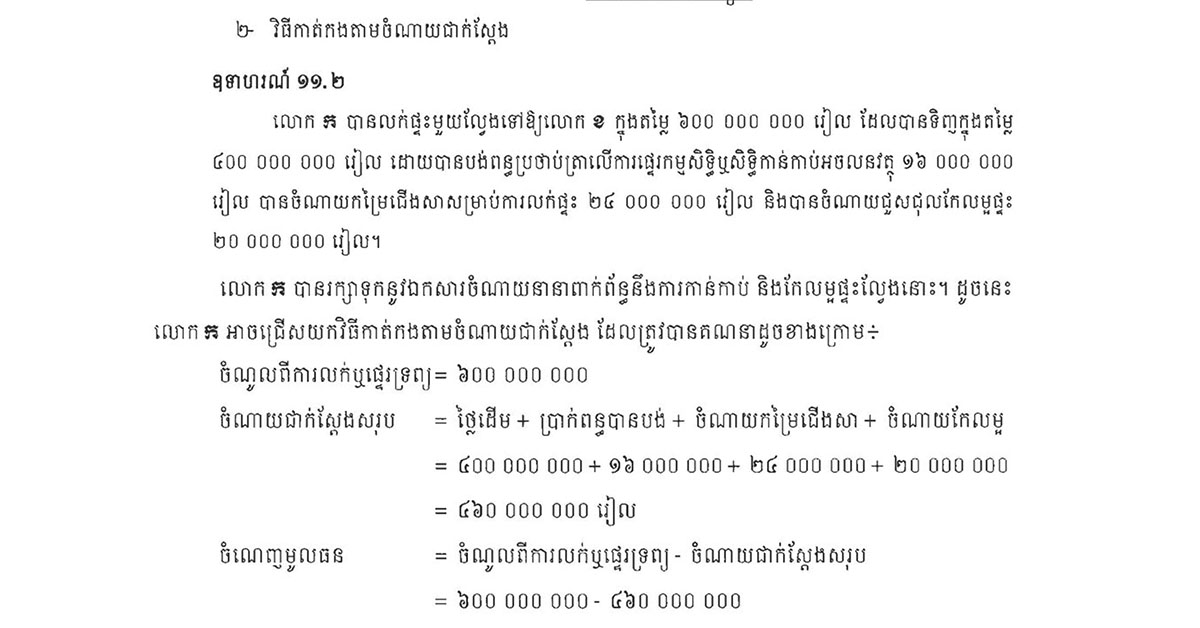

Taxpayers are allowed to choose one of two capital calculation methods:

- Deductible method: Allows deduction of 80% of proceeds from sales of assets or transfer

- Deduction method based on actual expenses

For example, in the first method, you sell land for US$1 million. You are allowed to deduct the principal and other expenses up to 80%. This means you earn only US$200,000 profit, and you have to pay a 20% tax, which is only US$40,000.

Director-General of Taxation HE Kong Vibol said that the implementation of capital gains tax is to be enforced in Cambodia in the same manner as other countries, where the tax rate on capital gains is up to 40% to 50%, such as in France and Australia.

“The government has allowed the GDT to collect tax on capital gains since July 2020, but because we need time to disseminate it, there was a delay in the implementation of the tax on capital gains until 01 January 2021,” he said.

The GDT is also producing educational videos related to the capital gains tax for taxpayers to understand the procedures, he added.

From: https://www.construction-property.com/gdt-to-start-tax-collection-on-capital-gain-from-january-next-year/