How to Start a Business: A Startup Guide for Entrepreneurs [Template]

![How to Start a Business: A Startup Guide for Entrepreneurs [Template]](https://www.cambodiaproperty.info/wp-content/uploads/2021/01/how-to-start-a-business-2-598x323.jpg)

How to Start a Business: A Startup Guide for Entrepreneurs [Template].

Everyone wants more visitors, more qualified leads, and more revenue. But starting a business isn’t one of those “if you build it, they will come” situations. So much of getting a startup off the ground has to do with timing, planning, and the market, so consider if the economic conditions are right to start a company and whether you can successfully penetrate the market with your solution.

Everyone wants more visitors, more qualified leads, and more revenue. But starting a business isn’t one of those “if you build it, they will come” situations. So much of getting a startup off the ground has to do with timing, planning, and the market, so consider if the economic conditions are right to start a company and whether you can successfully penetrate the market with your solution.

In order to build and run a successful company, you’ll also need to create and fine-tune a business plan, assess your finances, complete all the legal paperwork, pick your partners, research apps for startups growth, choose the best tools and systems to help you get your marketing and sales off the ground … and a whole lot more.

To help, I’ve put together a library of the best free tools and resources to help you start selling and marketing your business, and a complete guide on how to start a business. The guide covers everything from the paperwork and finances to creating your business plan and growing your business online.

Use the links below to navigate to each section of the guide.

How to Start a Business

- Write a business plan.

- Review the legal requirements to start a business.

- Determine your business’ legal structure.

- Register your business’ name.

- Understand small business tax requirements.

- Create a customer acquisition strategy for your business.

- Market the business.

- Sell your products and services.

- Keep your customers happy.

- Fund the business.

Starting a business involves a whole lot of moving pieces, some more exciting than others. Brainstorming business names? Fun! Filing taxes? … Not so fun. The trick to successfully getting your business off the ground is to meticulously plan and organize your materials, prioritize properly, and stay on top of the status and performance of each and every one of these moving parts.

From registering with the government to getting the word out about your business to making key financial decisions, here’s an overview of what you’ll need to do to start a successful business.

What Is a Business Plan?

A business plan is a living document that maps out the details of your business. It covers what your business will sell, how it will be structured, what the market looks like, how you plan to sell your product or service, what funding you’ll need, what your financial projections are, and which permits, leases, and other documentation will be required.

At its core, a business plan helps you prove to yourself and others whether or not your business idea is worth pursuing. It’s the best way to take a step back, look at your idea holistically, and solve for issues years down the road before you start getting into the weeds.

This post covers tips for writing a business plan, followed by an outline of what to include and business plan examples. Let’s start with some basic, overarching tips before we dive in to the details.

Featured Resource: Free Business Plan Template

Grab your free business plan template here and apply the practices below.

1. Narrow down what makes you different.

Before you start whipping up a business plan, think carefully about what makes your business unique first. If you’re planning to start a new athletic clothing business, for example, then you’ll need to differentiate yourself from the numerous other athletic clothing brands out there.

What makes yours stand out from the others? Are you planning to make clothing for specific sports or athletic activities, like yoga or hiking or tennis? Do you use environmentally friendly material? Does a certain percentage of your proceeds go to charity? Does your brand promote positive body image?

Understanding your brand’s positioning in the market will help you generate awareness and sales.

Remember: You’re not just selling your product or service — you’re selling a combination of product, value, and brand experience. Think through these big questions and outline them before you dive in to the nitty-gritty of your business plan research.

2. Keep it short.

Business plans are more short and concise nowadays than they used to be. While it might be tempting to include all the results of your market research, flesh out every single product you plan to sell, and outline exactly what your website will look like, that’s actually not helpful in the format of a business plan.

Know these details and keep them elsewhere, but exclude everything but the meat and potatoes from the business plan itself. Your business plan shouldn’t just be a quick(ish) read — it should be easy to skim, too.

3. You can (and should) change it as you go.

Keep in mind that your business plan is a living, breathing document. That means you can update your business plan as things change. For example, you might want to update it a year or two down the road if you’re about to apply for a new round of funding.

How to Write a Business Plan

- Write an executive summary.

- Describe your company and business model.

- Analyze your market’s conditions.

- Explain your product and/or service.

- Outline all operations & management roles.

- Design a marketing & sales strategy.

- Detail a financial plan with business costs, funding, and revenue projections.

- Summarize the above with an appendix.

Here are the key elements in a business plan template, what goes into each of them, and a sample business plan section at each step in the process.

1. Write an executive summary.

The purpose of the executive summary is to give readers a high-level view of the company and the market before delving in to the details. (Pro Tip: Sometimes it’s helpful to write the executive summary after you’ve put together the rest of the plan so you can draw out the key takeaways more easily.)

The executive summary should be about a page long, and should cover (in 1–2 paragraphs each):

- Overview: Briefly explain what the company is, where you’ll be located, what you’ll sell, and who you’ll sell to.

- Company Profile: Briefly explain the business structure, who owns it and what prior experience/skills they’ll bring to the table, and who the first hires might be.

- Products or Services: Briefly explain what you’ll sell.

- The Market: Briefly explain your main findings from your market analysis and product market fit.

- Financial Considerations: Briefly explain how you plan to fund the business and what your financial projections are.

Example of an “Overview” section of the Executive Summary (from Bplans):

Jolly’s Java and Bakery (JJB) is a start-up coffee and bakery retail establishment located in southwest Washington. JJB expects to catch the interest of a regular loyal customer base with its broad variety of coffee and pastry products. The company plans to build a strong market position in the town, due to the partners’ industry experience and mild competitive climate in the area.

JJB aims to offer its products at a competitive price to meet the demand of the middle-to higher-income local market area residents and tourists.

2. Describe your company and business model.

Next, you’ll have your company description. Here’s where you have the chance to give a summary of what your company does, your mission statement, business structure and business owner details, location details, the marketplace needs that your business is trying to meet, and how your products or services actually meet those needs.

Example of a “Company Summary” section (from Bplans):

NALB Creative Center is a startup, to go into business in the summer of this year. We will offer a large variety of art and craft supplies, focusing on those items that are currently unavailable on this island. The Internet will continue to be a competitor, as artists use websites to buy familiar products. We will stock products that artists don’t necessarily have experience with. We will maintain our price comparisons to include those available online.

We will offer classes in the use of new materials and techniques.

We will build an Artist’s Oasis tour program. We will book local Bed and Breakfasts; provide maps and guides for appropriate plein-air sites; rent easels and materials; sell paint and other supplies and ship completed work to the clients when dry.

We will expand the store into an art center including: A fine art gallery, offering original art at, or near, wholesale prices; Musical instruments/studio space; Classrooms for art/music lessons; Art/Music books; Live music/coffee bar; Do-it-Yourself crafts such as specialty T-Shirts, signs, cards, ceramics for the tourist trade.

3. Analyze your market’s conditions.

One of the first questions to ask yourself when you’re testing your business idea is whether it has a place in the market. The market will ultimately dictate how successful your business will be. What’s your target market, and why would they be interested in buying from you?

Get specific here. For example, if you’re selling bedding, you can’t just include everyone who sleeps in a bed in your target market. You need to target a smaller group of customers first, like teenagers from middle-income families.

From there, you might answer questions like: How many teenagers from middle-income families are currently in your country? What bedding do they typically need? Is the market growing or stagnant?

Include both an analysis of research that others have done, as well as primary research that you’ve collected yourself — whether by customer surveys, interviews, or other methods.

This is also where you’ll include a competitive analysis. In our example, we’d be answering the question: how many other bedding companies already have a share of the market, and who are they?

Outline the strengths and weaknesses of your potential competitors, as well as strategies that will give you a competitive advantage.

Example of a “Market Analysis” summary section (from Bplans):

Green Investments has identified two distinct groups of target customers. These two groups of customers are distinguished by their household wealth. They have been grouped as customers with <$1 million and >$1 million in household wealth. The main characteristic that makes both of these groups so attractive is their desire to make a difference in the world by making investment decisions that take into account environmental factors.

The financial services industry has many different niches. Some advisors provide general investment services. Others will only offer one type of investments, maybe just mutual funds or might concentrate on bonds. Other service providers will concentrate on a specific niche like technology or socially responsible companies.

Market Segmentation

Green Investments has segmented the target market into two distinct groups. The groups can be differentiated by their difference in household wealth, households of <$1 million and >$1 million.

- <$1 million (household worth): These customers are middle class people who have a concern for the environment and are taking personal action through their choosing of stock investments based on companies with both strong economic and environmental performance records. Because these people do not have an over abundance of money they choose stocks that are of moderate risk. Generally, this group has 35%-45% of their portfolio in stocks, the remaining percentages in other types of investments.

- >$1 million (household worth): These customers are upper middle class to upper class. They have amassed over $1 million in savings and are fairly savvy investors (themselves or the people they hire). These people are generally concerned about the rate of return of their investments but also have environmental concerns.

4. Explain your product and/or service.

Here’s where you can go into detail about what you’re selling and how it benefits your customers. If you aren’t able to articulate how you’ll help your customers, then your business idea may not be a good one.

Start by describing the problem you’re solving. Then, go into how you plan to solve it and where your product or service fits into the mix. Finally, talk about the competitive landscape: What other companies are providing solutions to this particular problem, and what sets your solution apart from theirs?

Example of a “Products and Services” section (from Bplans):

AMT provides both computer products and services to make them useful to small business. We are especially focused on providing network systems and services to small and medium business. The systems include both PC-based LAN systems and minicomputer server-based systems. Our services include design and installation of network systems, training, and support.

Product and Service Description

In personal computers, we support three main lines:

1. The Super Home is our smallest and least expensive line, initially positioned by its manufacturer as a home computer. We use it mainly as a cheap workstation for small business installations. Its specifications include …[additional specifics omitted]

2. The Power User is our main up-scale line. It is our most important system for high-end home and small business main workstations, because of …. Its key strengths are …. Its specifications include ….[additional specifics omitted]

3. The Business Special is an intermediate system, used to fill the gap in the positioning. Its specifications include … [additional specifics omitted]

In peripherals, accessories and other hardware, we carry a complete line of necessary items from cables to forms to mousepads … [additional specifics omitted]

In service and support, we offer a range of walk-in or depot service, maintenance contracts and on-site guarantees. We have not had much success selling service contracts. Our networking capabilities …[additional specifics omitted]

Competitive Comparison

The only way we can hope to differentiate well is to define the vision of the company to be an information technology ally to our clients. We will not be able to compete in any effective way with the chains using boxes or products as appliances. We need to offer a real alliance.

The benefits we sell include many intangibles: confidence, reliability, knowing that somebody will be there to answer questions and help at the important times.

These are complex products, products that require serious knowledge and experience to use, and our competitors sell only the products themselves.

Unfortunately, we cannot sell the products at a higher price just because we offer services; the market has shown that it will not support that concept. We have to also sell the service and charge for it separately.

5. Outline all operations & management roles.

Use this section to outline your business’ unique organization and management structure (keeping in mind that you may change it later). Who will be responsible for what? How will tasks and responsibilities be assigned to each person or each team?

Includes brief bios of each team member and highlight any relevant experience and education to help make the case for why they’re the right person for the job. If you haven’t hired people for the planned roles yet, that’s OK — just make sure you identify those gaps and explain what the people in those roles will be responsible for.

Example of an “Personnel Plan” section of the Operations & Management section (from Bplans):

The labor force for DIY Wash N’ Fix will be small. It will consist of a part-time general manager to handle inter-business relationships and corporate responsibilities. In addition, DIY Wash N’ Fix will employ three certified mechanics/managers; their duties will consist of the day-to-day operation of the firm. These duties fall into two categories: managerial and operational. Managerial tasks include: scheduling, inventory control and basic bookkeeping. Safety, regulatory issues, customer service and repair advice are the operational tasks they will be responsible for.

Additionally, customer service clerks will be hired to perform the most basic tasks: customer service and custodial. DIY Wash N’ Fix will have a single general manager to coordinate all outside business activities and partnerships. The business relationships would include accounting services, legal counsel, vendors and suppliers, maintenance providers, banking services, advertising and marketing services, and investment services. Laurie Snyder will fill this general management position. She will be receiving an MBA from the University of Notre Dame in May 2001.

The daily management of the business will be left to the lead mechanic. Even though DIY Wash N’ Fix is not a full service repair shop it can be expected that some customers will attempt repairs they are not familiar with and need advice. Therefore, we intend to hire three fully certified mechanics. The mechanics will not be authorized to perform any work on a customer’s car, but they will be able to take a look at the car to evaluate the problem. To reduce our liability for repairs done incorrectly we feel only professional mechanics should give advice to customers. The primary function of the mechanics will be customer service and managerial responsibilities.

6. Design a marketing & sales strategy.

This is where you can plan out your comprehensive marketing and sales strategies that’ll cover how you actually plan to sell your product. Before you work on your marketing and sales plan, you’ll need to have your market analysis completely fleshed out, and choose your target buyer personas, i.e., your ideal customers. (Learn how to create buyer personas here.)

On the marketing side, you’ll want to cover answers to questions like: How do you plan to penetrate the market? How will you grow your business? Which channels will you focus on for distribution? How will you communicate with your customers?

On the sales side, you’ll need to cover answers to questions like: what’s your sales strategy? What will your sales team look like, and how do you plan to grow it over time? How does you plan to scale for growth?

How many sales calls will you need to make to make a sale? What’s the average price per sale? Speaking of average price per sale, here’s where you can go into your pricing strategy.

Example of a “Marketing Plan” section (from Bplans):

The Skate Zone plans to be the first amateur inline hockey facility in Miami, Florida. Due to the overwhelming growth of inline hockey throughout the United States, the company’s promotional plans are open to various media and a range of marketing communications. The following is a list of those available presently.

Public relations. Press releases are issued to both technical trade journals and major business publications such as USAHockey Inline, INLINE the skate magazine, PowerPlay, and others.

Tournaments. The Skate Zone will represent its services at championship tournaments that are held annually across the United States.

Print advertising and article publishing. The company’s print advertising program includes advertisements in The Yellow Pages, Miami Express News, The Skate Zone Mailing, school flyers, and inline hockey trade magazines.

Internet. The Skate Zone currently has a website and has received several inquiries from it. Plans are underway to upgrade it to a more professional and effective site. In the future, this is expected to be one of the company’s primary marketing channels.

7. Detail a financial plan with business costs, funding, and revenue projections.

Finally, outline your financial model in detail, including your start-up cost, financial projections, and a funding request if you’re pitching to investors.

Your start-up cost refers to the resources you’ll need to get your business started — and an estimate of how much each of those resources will cost. Are you leasing an office space? Do you need a computer? A phone? List out these needs and how much they’ll cost, and be honest and conservative in your estimates. The last thing you want to do is run out of money.

Once you’ve outlined your costs, you’ll need to justify them by detailing your financial projections. This is especially important if you’re looking for funding for your business (which you’ll learn more about below). Make sure your financial model is 100% accurate for the best chance of convincing investors and loan sources to support your business.

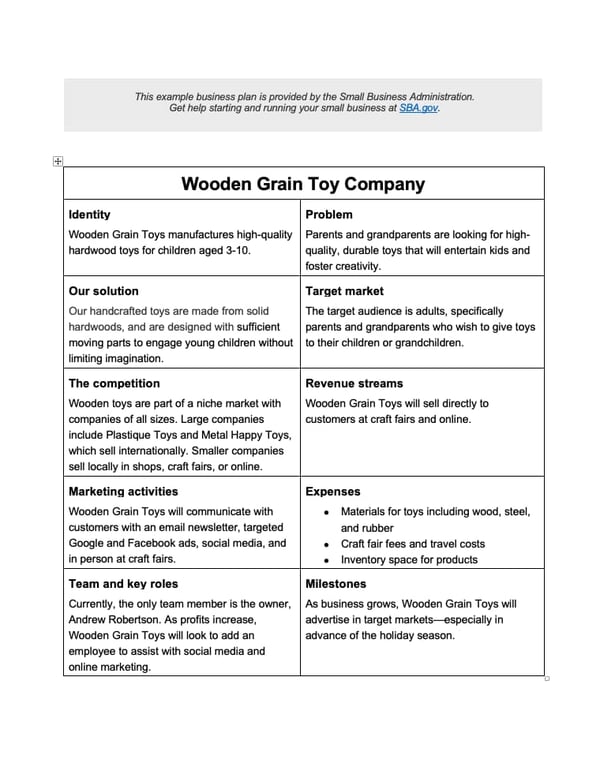

The following table is the projected Profit and Loss statement for Markam. (from Bplans):

8. Summarize the above with an appendix.

Finally, consider closing out your business plan with an appendix. The appendix is optional, but it’s a helpful place to include your resume and the resume(s) of your co-founder(s), as well as any permits, leases, and other legal information you want to include.

Business Plan Template

Before you begin your business plan, download this business plan template. It provides an outline for you to follow and simplifies the process.

The first steps are to create a cover page, and write a description of your business that outlines your product or service and how it solves a need for your customers. The next step is to work on the company description which provides detail on how your company will be organized and includes the mission statement.

In the next section of the business plan template, you’ll identify your target audience or buyer personas. Through research, surveys, and interviews, you’ll understand who wants your product, why their interested, and what problem your offering solves for them.

The next step is to describe your line of products and services in detail, including the pricing model, and the advantage you have over competitors.

From there, you’ll write down your plan to market and sell your product or service. You’ll also identify your growth plan and set targets and measures for your marketing and sales activities.

Then, you’ll determine which legal structure your business will have (LLP, sole proprietorship, etc.), and if there are any other legal factors you need to consider (e.g., permits, licenses, health codes.)

Finally, financial projections will be made, and short-term and long-term goals will be set for the business.

Business Plan Examples

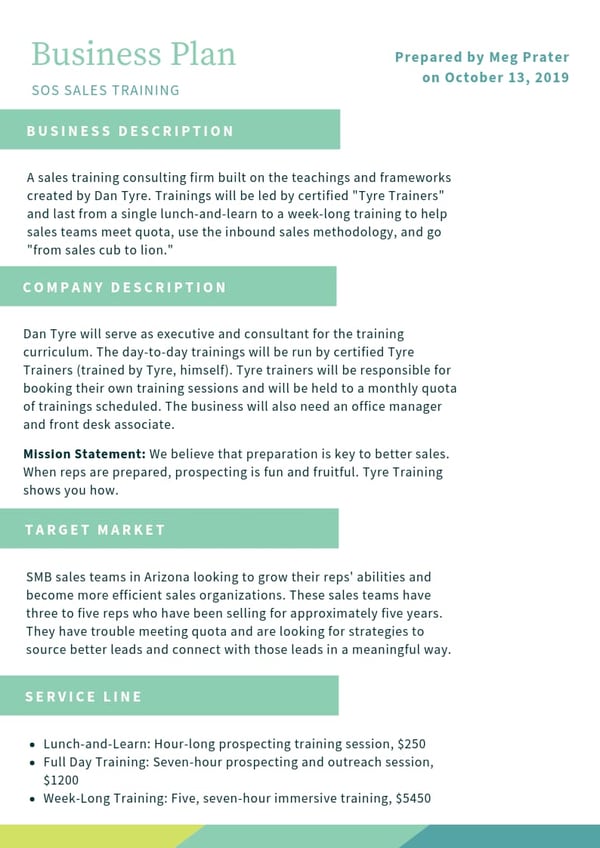

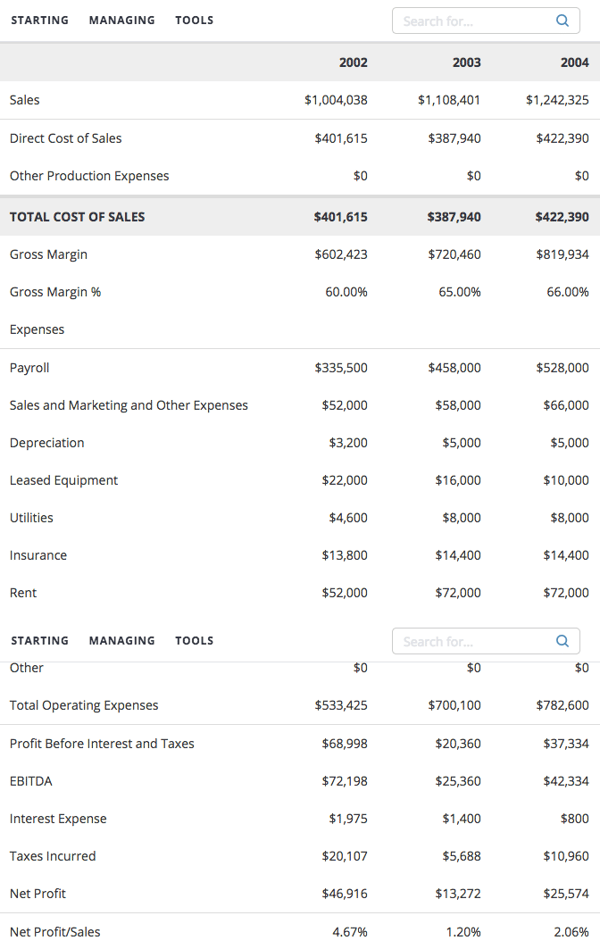

Below are sample business plans that was created using the business plan template.

Legal Requirements to Start a Business

Once the business plan is in place, you get to move on to the even less romantic part — the paperwork and legal activities. This includes things like determining the legal structure of your business, nailing down your business name, registering with the government, and — depending on your business structure and industry — getting a tax code, a business license, and/or a seller’s permit.

Furthermore, businesses are regulated on the federal, the state, and sometimes even local level. It’s important to check what’s required on all three of those levels. When you register your business with the government, be sure you’re covering registration on all the levels required for your business’ location. Your business won’t be a legal entity without checking these boxes, so stay on top of it.

Below, you’ll find a brief explanation of what goes into each one of these steps, along with links to helpful resources where you can dig in to the details. (Note: These steps are for starting a business in the U.S. only.)

Business Legal Structure

The 4 most common business structures are:

1. Sole proprietorship

- Example: Freelance graphic design.

- What it is: A sole proprietorship is a business that’s owned and run by one person, where the government makes no legal distinction between the person who owns the business and the business itself. It’s the simplest way to operate the business. You don’t have to name your business anything other than your own, personal name, but if you want to, you can give it its own distinctive name by registering what’s called a Doing Business Name (DBA). (We’ll get back to that in the “How to Register a Business Name” section.)

- Pros: It’s easy and inexpensive to create a sole proprietorship because there’s only one owner, and that owner has complete control over all business decisions. Tax preparation is also pretty simple since a sole proprietorship is not taxed separately from its owner.

- Cons: It can be dramatically more difficult to raise money and get investors or loans because there’s no legal structure that promises repayment if the business fails. Also, since the owner and the business are legally the same, the owner is personally liable for all the debts and obligations of the business.

- How taxes work: The individual proprietor owns and manages the business and is responsible for all transactions, including debts and liabilities. Income and losses are taxed on the individual’s personal income tax return at ordinary rates. In addition, you are also subject to payroll taxes, or self-employment taxes, on the money you earn. (More on self-employment taxes later.) Find IRS tax forms here.

2. Partnership

- Example: Multiple doctors maintaining separate practices in the same building.

- What it is: A partnership is a single business where two or more people share ownership, and each owner contributes to all aspects of the business as well as shares in the profits and losses of the business.

- Pros: It’s generally pretty easy to form a business partnership, and it doesn’t tend to be super expensive, either. Having two or more people equally invested in the business’ success allows you to pool resources. It also means you have access to more than one person’s skill set and expertise.

- Cons: Just like a sole proprietor, partners have full, shared liability if the business goes south. That also means that partners aren’t just liable for their own actions, but also the actions of their partner(s). There is a variant on partnerships called a limited liability partnership, or LLP, that protects against that — which is how most law firms are organized, for example. Finally, when more than one person is involved in decisions, there’s room for disagreement — which means it’s important to have an explicit agreement over how the obligations and earnings will be split, especially if/when things go wrong.

- How taxes work: To form a partnership, you have to register your business with your state, a process generally done through your Secretary of State’s office. Find IRS tax forms here.

3. Limited liability company (LLC)

Example: A small design firm.

- What it is: LLCs are a type of business structure that’s more complex than sole proprietorships and partnerships, but less complex than corporations. They are called “pass-through entities” because they’re not subject to a separate level of tax. Most states don’t restrict ownership on LLCs, and so members can include individuals, corporations, and even other LLCs and foreign entities. Most states also permit “single-member” LLCs, those having only one owner.

- Pros: As the name suggests, owners of an LLC have limited liability, meaning that they personally are not responsible for any financial or legal faults of the business. This reduction in risk is what makes an LLC a very popular business structure.

- Cons: LLCs are often more complex than sole proprietorships or partnerships, which means higher initial costs, and certain venture capital funds are hesitant to invest in LLCs because of tax considerations and the aforementioned complexity. That being said, they’re simpler to operate than a corporation because they aren’t subject to as many formalities.

- How taxes work: LLCs have the benefit of a “flow-through” tax treatment, meaning that the owners – not the LLC – are the ones who are taxed. Having only one level of tax imposed makes taxes easier. Find IRS tax forms here.

4. Corporation

- Example: Microsoft, Coca-Cola, Toyota Motor, and almost all well known businesses.

- What it is: A legal entity that is separate and distinct from its owners, and has most of the rights and responsibilities that an individual possesses (to enter into contracts, loan and borrow money, sue and be sued, hire employees, own assets, and pay taxes.) It’s more complex than the other business structures, and it’s generally suggested for larger, established companies with multiple employees.

- Pros: They make seeking venture financing easy. They also provide the best protection for personal assets, as the founders, directors, and stockholders are (usually) not liable for the company’s debts and obligations – only the money and resources they’ve personally invested.

- Cons: Because they’re much more complex than other business structures, they can have costly administrative fees, and more complicated tax and legal requirements.

- How taxes work: Corporations are required to pay federal, state, and in some cases, local taxes. There are two different types of corporations: “C corporations” and “S corporations.” C corporations are subject to double taxation – so any profit a C corporation makes is taxed to the corporation when earned, and then is taxed to the shareholders when distributed as dividends.

The corporation does not get a tax deduction when it distributes dividends to shareholders. Shareholders cannot deduct any loss of the corporation, but they are also not responsible directly for taxes on their earnings – just on the dividends they give to shareholders.

S corporations, on the other hand have only one level of taxation. Learn more about the difference between “C corporations” and “S corporations” here, and find IRS tax forms here.

How to Register a Business Name

- Make sure the name you want is available in your state.

- Conduct a trademark search.

- If you are a new corporation or LLC, your business name will automatically be registered with your state when you register your business.

- If you are a sole proprietorship, partnership, or existing corporation or LLC, register a “Doing Business As” (DBA) name.

- File for a trademark when you’ve chosen an original name.

Naming your business is a little more complicated than making a list and picking your favorite. If you’re using a name other than your personal name, then you need to register it with your state government so they know you’re doing business with a name other than your given name.

1. Make sure the name you want is available in your state.

Before you register, you need to make sure the name you want is available in your state. Business names are registered on a state-by-state basis, so it’s possible that a company in another state could have the same name as yours. This is only concerning if there’s a trademark on the name.

2. Conduct a trademark search.

Do a trademark search of your desired name to avoid expensive issues down the road. The search will tell you if another business has registered or applied for the trademark you’d like to use.

3. If you are a new corporation or LLC, your business name will automatically be registered with your state when you register your business.

For new corporations and LLCs: Your business name is automatically registered with your state when you register your business — so you don’t have to go through a separate process. There are rules for naming a corporation and LLC, which you can read about here.

4. If you are a sole proprietorship, partnership, or existing corporation or LLC, register a “Doing Business As” (DBA) name.

For sole proprietorships, partnerships, and existing corporations and LLCs (if you want to do business with a name other than their registered name), you’ll need to register what’s called a “Doing Business As” (DBA) name. You can do so either by going to your county clerk office or with your state government, depending which state you’re in. Learn how to do that here.

5. File for a trademark when you’ve chosen an original name.

Want to trademark your business name? A trademark protects words, names, symbols, and logos that distinguish goods and services. Filing for a trademark costs less than $300, and you can learn how to do it here.

What Is a Seller’s Permit?

If your business sells tangible property to the public either as a wholesaler or retailer, then in most states, you need to apply for a seller’s permit. “Tangible property” simply means physical items, like clothing, vehicles, toys, construction materials, and so on. In some states, a seller’s permit is required for service-oriented business, too, such as accountants, lawyers, and therapists.

The seller’s permit allows you to collect sales tax from buyers. You’ll then pay that sales tax to the state each quarter by putting the sales tax permit number on the state’s tax payment form.

You can register for a seller’s permit through your state’s Board of Equalization, Sales Tax Commission, or Franchise Tax Board. To help you find the appropriate offices, find your state on this IRS website.

What Is a Business License?

Almost every business needs some form of license or permit to operate legally – but the requirements vary, which can get confusing. Which specific licenses or permits does your business need? To figure that out, go to this SBA.gov website and select the state from which you’re operating your business. It’ll tell you the specific license and permit requirements in that state.

Understanding Small Business Tax Requirements

Business owners are obligated to pay specific federal taxes, and the amount of those taxes is determined by the form of business entity that you establish. All businesses except for partnerships need to file an annual income tax return. Partnerships file what’s called an information return.

Any business that’s owned and operated in the United States needs an Employer Identification Number (EIN), which you can apply for on the IRS’ website here. Once you’re registered, it’s time to figure out which taxes you’ll be responsible for. Here are the three types:

Self-Employment Tax (SE Tax)

A Social Security and Medicare tax for people who work for themselves, i.e. business owners. SE taxes require filing Schedule SE (Form 1040) if your net earnings from self-employment were $400 or more. (Note: There are special rules and exceptions for fishing crew members, notary public, and more.) Learn More

Employment Tax

When you have employees, you (as the employer) have certain employment tax responsibilities that you need to pay, as well as forms you need to file. Employment taxes include Social Security and Medicare taxes, federal income tax withholding, and federal unemployment (FUTA) tax. Learn More

Excise Tax

Excise taxes are also something you need to consider, depending what you sell, where you operate, and so on. For example, in the U.S., there’s a federal excise tax on certain trucks, truck tractors, and buses used on public highways. Learn More

Customer Acquisition Strategy for a New Business

Turns out that generating demand and earning customers needs to come before you can viably ask for funding from an external source.

Once you’ve registered your new business with the government and gotten the legal paperwork squared away, how do you go about, you know … acquiring customers?

Before you can receive any significant funding for your business (which we’ll talk about in the next section), you need to:

- Start marketing your business and building an online presence

- Get a sales process together and begin to sell your product or service

- Strategize how to keep your customers happy to earn testimonials, word-of-mouth referrals, and repeat business (to keep your customer acquisition engine going)

Marketing Your Small Business

A new company needs to start drumming up interest for its product or service even before it’s ready to ship. But there are a million different platforms and avenues you can use to drive awareness … so where on earth do you start?

1. Narrow down your target customer.

It all comes down to your target customer. You won’t be able to position what you’re selling to meet customers’ needs without knowing who they are. One of the very first questions you need to ask yourself is: Who wants what I’m selling? Who would find it useful? Who would love it?

Then, you need to dig in to who that person is or those people are, and what kind of messaging would resonate with them. That includes their backgrounds, interests, goals, and challenges, in addition to how old they are, what they do every day, which social platforms they use, and so on.

Creating very specific buyer personas can dramatically improve your business results. Read this step-by-step guide on how to create buyer personas, which includes buyer persona templates you can customize yourself. Once you’ve picked a buyer persona or two, print them out, tack them onto your wall, and think about their interests and needs before making every business decision.

2. Develop a brand identity.

In addition to researching your target customer, when you’re first starting a business, you’ll need to build the foundation for a strong brand identity. Your brand identity is about your values, how you communicate concepts, and which emotions you want your customers to feel when they interact with your business. Having a consistent brand identity to promote your business will make you look more professional and help you attract new customers.

3. Build your online presence.

With your target customer and your brand identity under your belt, you can begin building the core marketing elements of your small business, which includes your website, your blog, your email tool, your conversion tool, and your social media accounts. To dive deeper into these topics, read our beginner’s guide to small business marketing here.

4. Generate and nurture leads.

Once you’ve started building an online presence and creating awareness for your business, you need to generate the leads that will close into customers. Lead generation is the process of attracting and converting strangers and prospects into leads, and if you build a successful lead generation engine, you’ll be able to keep your funnel full of sales prospects while you sleep.

What does a successful lead generation process look like? Learn more about lead generation here, and click the button below to try HubSpot’s free marketing tools, our free lead generation tool that lets you track your website visitors and leads in a single contact database.

Free Marketing Tools & Resources

Here are some helpful resources to help you spread awareness, build your online presence, and get the leads you need for free.

- Marketing Plan: A Blueprint for Start-Ups – A 20-page guide that covers how to build a sales and marketing machine, which demand generation activities with the biggest return on investment, and more. Get the Guide

- HubSpot’s Free Marketing Tools – Free marketing tool that gives you insight into what every lead does before and after they fill out a form. It includes built-in analytics that make it easy to learn which pages, offers, and traffic sources are driving the most conversions for you. Get the Free Tool

- Website Grader – Enter your website URL and email address, and you’ll get a detailed grade on your website’s performance, mobile, SEO, and security, along with detailed tips and resources for making impactful improvements on your website. Assess My Website

- Press Release Templates – Downloadable press release templates you can customize, along with a corresponding guide to building a press release and promotion plan. Get Your Press Release Templates

- Case Study Templates – Downloadable case study templates you can customize, tips on how to find and reach out to candidates, and sample interview questions. Get Your Case Study Templates

- Content Creation Templates – 100 social media image templates, 8 PowerPoint presentation templates, 50 call-to-action templates, 15 infographic templates, 5 ebook templates, 5 blog post templates, and more. Get Your Content Templates

Selling Your Products or Services

1. Set up your sales infrastructure.

By taking the time to set up your sales process from the get-go, you’ll avoid painful headaches that come with lost data down the line. Start with a CRM, which is a central database where you can keep track of all your clients and prospective clients in one place. There are loads of options out there, and you’ll want to evaluate the CRMs that cater to small businesses. (Excel doesn’t count!)

2. Identify your sales goals.

Don’t get intimidated by sales lingo such as KPIs and ROI. All this means is that you need to figure out what you need coming into your business to make ends meet and grow: how much revenue do you need, and how many products do you need to sell to hit that target?

3. Hire a sales rep.

When you’re starting your business, it’s tempting to do everything yourself, including taking on sales. However, making that first sales hire is crucial to scaling – you need someone dedicated to understanding your buyer and selling to them full-time. When looking for that first sales hire, seniority should be less of a priority than how much sales experience they have on the front lines and whether they understand your business’s target buyer. From there, you’ll want a plan for building your sales development team.

4. Get more out of your sales activities.

Efficiency is key. Put together a sales process, such as this helpful 7-step sales process framework, which works regardless of your business size. You’ll also want to automate sales tasks (such as data entry), or set up notifications when a prospective customer takes an action. That way, you spend less time poring through records and calling the wrong prospects and more on strategy and actual selling.

Free Sales Tools & Resources

Here are some helpful templates and sales tools to help you build an efficient sales engine, reach prospects, and close customers for free.

- Email Signature Generator – A free tool that creates a professional email signature you can easily add to your Gmail, Outlook, Apple Mail, Yahoo Mail, or any other email provider. Make Your Own Email Signature

- Sales Email Templates – A list of 21 email templates that have been used with tremendous success by real companies (including HubSpot.) Get Your Sales Email Templates

- Sales Call Scripts – Easy-to-follow sales call checklist that can help you build rapport and develop trust, understand the prospect’s pain points, identify key decision-makers, and secure a follow-up meeting. Check Out The Sales Call Scripts

- Daniel Pink’s “Sell Like a Human” Video Series – Monthly video series where Sales Expert Daniel Pink and special guests solve your biggest sales challenges in under 30 minutes. Watch the Video Series

- Sales Close Rate Industry Benchmarks Tool – Compare your sales close rate against your industry competitors using data from over 8,900 companies segmented by 28 industries. Compare Your Sales Close Rate

Enroll in HubSpot Academy to learn everything you need to know about digital marketing and sales. Train your whole team for free! Sign Up For Free

Keeping Your Customers Happy

Getting net new customers in the door is important, but retaining them is just as important. You can’t ignore customers once you’ve closed them – you have to take care of them, give them stellar customer service, and nurture them to become fans of (and even evangelists for) your business.

While inbound marketing and sales are both critical to your funnel, the funnel doesn’t end there: The reality is that the amount of time and effort that you spend perfecting your strategy in those areas will amount to very little if you’re unable to retain happy customers.

This means that building a model for customer success should be central to your organization.

Think for a second about all the different ways reviews, social media, and online aggregators spread information about your products.

They’re all quick and effective, for better or for worse. While your marketing and sales playbooks are within your control and yours to perfect, a large chunk of your prospects are evaluating your company based on the content and materials that other people are circulating about your brand.

Here are some tips for how to keep your customers happy and stand out as a stellar business:

1. React quickly.

People expect fast resolution times (some faster than others depending on the channel), so it’s essential to be nimble and efficiently keep up with requests so that you’re consistently providing excellent service to avoid losing trust with your customers.

Pay attention to the volume of your company mentions on different channels. Identify where your customers spend the most time and are asking the most questions, and then meet them there, whether it’s on a social network, on Yelp, or somewhere else.

2. Keep track of touchpoints with individual customers.

Interactions with your customers are best informed by context. Keep track of all the touchpoints you’ve had with individual customers because having a view into their experience with your company will pay dividends in the long run.

How long have they been a customer? What was their experience in the sales process? How many purchases have they made? Have they given positive/critical feedback about your support experience or products? Knowing the answers to these questions will give you a more complete picture when you respond to inquiries and will help you have more productive conversations with customers.

3. Create feedback loops.

From the moment you have your first customer, you should be actively seeking out insights from them. As your business grows, this will become harder — but remember that your customer-facing employees are a valuable source of information because they are most in tune with your buyers and potential buyers.

4. Create a FAQ page for your website.

Give customers the tools to help themselves, and scale this program as you grow. When you’re starting out, this might take the form of a simple FAQ page. Over time, as your customer base grows, turn your website into a resource for your customers and enable them to self-service – such as evolving that FAQ page into a knowledge base or library that answers common questions and/or gives customers instructions.

Small Business Funding

- Seed Financing

- Accelerator

- Small Business Loan

- Crowdfunding

- Venture Capital Financing

From the day you start building your business until the point where you can make a consistent profit, you need to finance your operation and growth with start-up capital. Some founders can finance their business entirely on their own dime or through friends and family, which is called “bootstrapping.”

This obviously gives the business owners a ton of flexibility for running the business, although it means taking on a larger financial risk — and when family’s involved, can lead to awkward holiday dinner conversations if things go wrong.

Many founders need external start-up capital to get their business off the ground. If that sounds like you, keep on reading to learn about the most common kinds of external capital you can raise.

1. Seed Financing

If you’re looking for a relatively small amount of money, say, the investigation of a market opportunity or the development of the initial version of a product or service, then Seed financing might be for you.

There are many different kinds of seed financing, but the one you’ve probably heard of most is called Seed-round financing. In this case, someone will invest in your company in exchange for preferred stock. If your company gets sold or liquidated, then investors who hold preferred stock often have the right to get their investment back — and, in most cases, an additional return, called “preferred dividends” or “liquidation preferences” — before holders of common stock are paid.

2. Accelerator

Accelerators are highly competitive programs that typically involve applying and then competing against other startups in a public pitch event or demo day. In addition to winning funding and seed capital, winners of these programs are also rewarded with mentorship and educational programs.

Although accelerators were originally mostly tech companies and centered around Silicon Valley, you can now find them all over the country and in all different industries. If this sounds like something you’d be interested in, here’s a list of the top accelerators in the United States to get you started.

3. Small Business Loan

If you have a really rock-solid plan for how you’ll spend the money in place, then you might be able to convince a bank, a lender, a community development organization, or a micro-lending institution to grant you a loan.

There are many different types of loans, including loans with the bank, real estate loans, equipment loans, and more. To successfully get one, you’re going to need to articulate exactly how you’ll spend every single penny — so make sure you have a solid business plan in place before you apply. You can learn more about SBA.gov’s loan programs here.

4. Crowdfunding

You might ask yourself, what about companies that get funding through platforms like Kickstarter and Indiegogo? That’s called crowdfunding, which is a newer way of funding a business.

More importantly, it typically doesn’t entail giving partial ownership of the business away. Instead, it’s a way of getting funding not from potential co-owners, but from potential fans and customers who want to support the business idea, but not necessarily own it.

What you give donors in exchange is entirely up to you — and typically, people will come away with early access to a product, or a special version of a product, or a meet-and-greet with the founders. Learn more about crowdfunding here.

5. Venture Capital Financing

Only a very small percentage of businesses are either fit for venture capital or have access to it. All the other methods described earlier are available to the vast majority of new businesses.

If you’re looking for a significant amount of money to start your company and can prove you can quickly grow its value, then venture capital financing is probably the right move for you.

Venture capital financing usually means one or more venture capital firms make large investments in your company in exchange for preferred stock of the company — but, in addition to getting that preferred return like they would in series seed financing, venture capital investors also usually get governance rights, like a seat on the Board of Directors or approval rights on certain transactions.

VC financing typically occurs when a company can demonstrate a significant business opportunity to quickly grow the value of the company but requires significant capital to do so.

Once you have a solid business plan and the tools and financing to execute your goals, you’ll be on the path to launching your business.

Editor’s note: This post was originally published in August 2019 and has been updated for comprehensiveness.

![]()