The Sales Revenue Formula: How to Use It and Why It Matters

The Sales Revenue Formula: How to Use It and Why It Matters

I’m going to say something that isn’t going to come as a surprise to anyone. I think it’s pretty blunt and noncontroversial, and I promise I’m going somewhere with it.

Here it is … businesses want to make money. That’s more or less why they sell goods and services or even exist in the first place. Generating income is critical to how companies stay afloat, expand, and do almost everything else they do.

The statements above are obvious, but understanding how that income is tracked, recorded, segmented, and analyzed isn’t quite as straightforward. There are several different metrics, calculations, and variants involved in making sense of the money a business brings in.

One of those potentially confusing metrics is known as sales revenue, and I’ve compiled information to offer you some insight into what it is, how to calculate it, how it relates to other income figures, and why it’s important to understand it.

There are two variations of sales revenue: gross and net. Both may be reported on an income statement, but each metric has its own specific calculation and business implications.

Gross sales revenue is comprised of all the income a company generates by way of its sales of goods and services. This figure is indicative of a business’s ability to sell its products or services, but it doesn’t necessarily demonstrate its ability to generate profit.

Net sales revenue is a business’s gross sales revenue minus any returns and allowances. Of the two categories, this figure is a more accurate representation of the amount of cash a company receives from its customers.

Returns are exactly what they sound like: money lost to products that get returned. Any time a customer gives a defective or unwanted product back to a company for a refund, that company’s net sales revenue takes a hit.

Companies deduct allowances when they sell a defective product to a customer at a reduced price point. If a customer is willing to take an inferior product for less money, allowances account for the difference.

How to Calculate Sales Revenue [Formula]

Use one of the following formulas to calculate sales revenue:

Sales revenue for product-based companies

Number of Units Sold x Average Price = Sales Revenue

Sales revenue for service-based companies

Number of Customers x Average Price of Services = Sales Revenue

Some sales professionals might use the words “revenue” and “sales” interchangeably in casual conversation, but the two can and should be differentiated when it comes to accounting. Sales are all the money a company receives by selling products or services. Revenue includes all the money a company receives, period.

Companies can generate income from a variety of sources beyond their products and services. A business could see returns on investments it might have made. It could receive licensing fees from businesses using its name or logo. It could collect charges or interest from delinquent customers or take any other action that would bring in money without actually moving products or providing services.

In short, revenue can come without sales, but all sales are inherently revenue.

Why Is Sales Revenue Important?

Sales revenue is the first metric reported on an income statement — and for good reason. It represents the starting point for companies to determine their net income: the basis for business-critical calculations and reports, including earnings per share and cash flow statements.

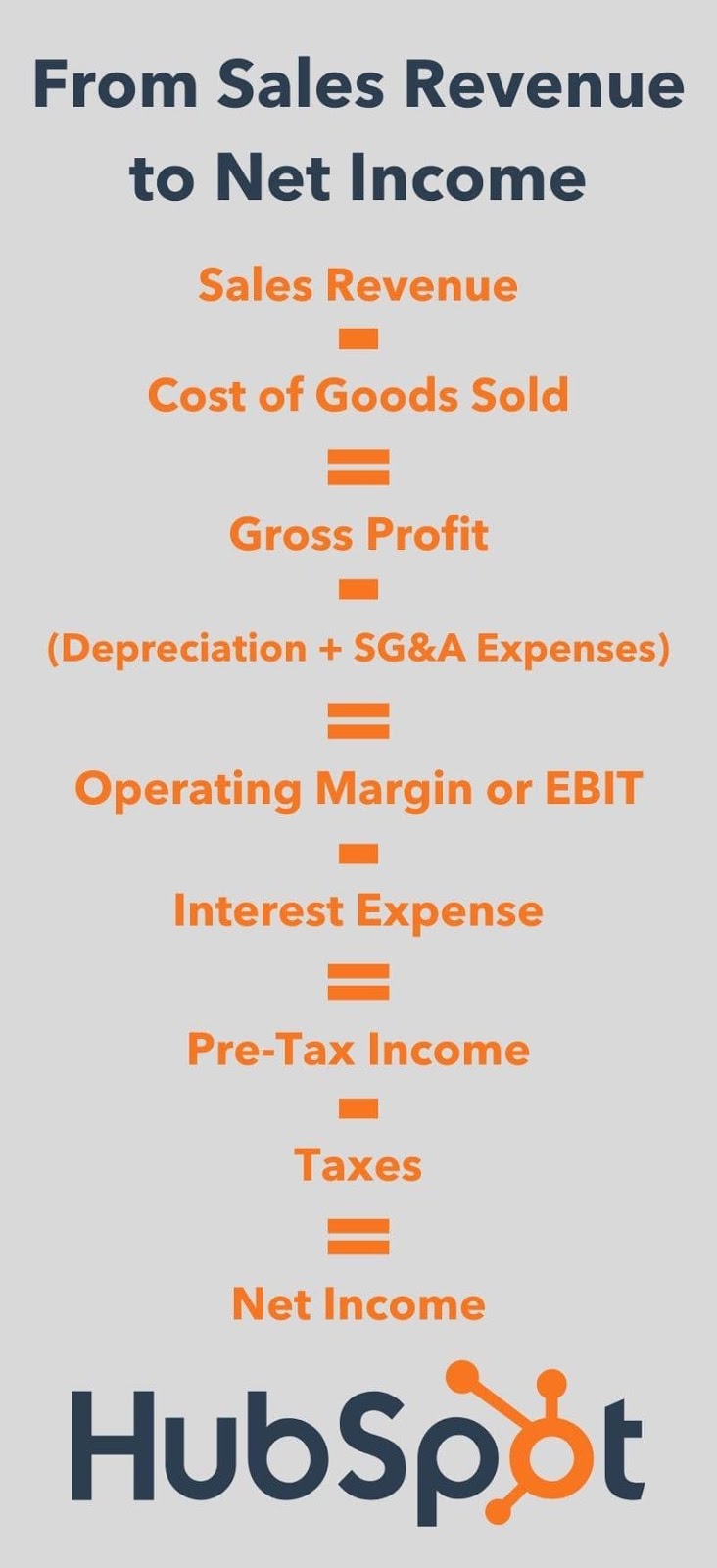

To get from sales revenue to net income, a company first subtracts its costs of goods sold from its sales revenue to find its gross profit. Then, it subtracts any depreciation and SG&A (selling, general, and administrative) expenses from its gross profit to find its operating margin — also referred to as its earnings before interest and taxes or EBIT.

Then, it subtracts its interest expense from its operating margin to find its pre-tax income. Finally, it subtracts its taxes from its pre-tax income to find its net income. Net income is one of the most essential metrics for gauging the health and planning the future of a business, but you can’t find it without starting with sales revenue.

Sales revenue is also one of the most effective metrics for historical analysis and forecasting. That’s what makes its position at the top of an income statement significant. Other figures listed below the top line are often expressed as a percentage of sales revenue. It provides one of the best reference points for predicting the future of any other figure on the statement.

I’ll refer back to the absolutely mind-blowing revelation I bravely and boldly shared at the beginning of the article — businesses want to make money. A big part of that process is understanding what that money means as it comes in.

And a big part of that process is understanding sales revenue.

![]()

Source: hubspot sales