The Ultimate Guide to Sales Metrics: What to Track, How to Track It, & Why

The Ultimate Guide to Sales Metrics: What to Track, How to Track It, & Why

You can’t manage what you don’t measure.

While metrics are important in every aspect of any business, they’re especially critical in sales. Sales leaders can’t use their intuition to guide their decisions — not only are they dealing with a huge amount of information, but the risk of failure is high.

That’s why successful companies obsessively measure everything about their go-to-market model, sales strategy, and salespeople.

To help you find the numbers you need to be paying attention to, we’ve compiled the ultimate guide to sales metrics.

Let’s take a look at what sales metrics are.

Now, you might be wondering what types of sales metrics there are and which ones you should be tracking. Let’s review some of the most important metrics for your business to keep track of.

1. Sales Key Performance Indicators (KPIs)

These sales metrics are important for measuring company-wide performance:

- Total revenue

- Revenue by product or product line

- Market penetration

- Percentage of revenue from new business

- Percentage of revenue from existing customers (cross-selling, upselling, repeat orders, expanded contracts, etc.)

- Year-over-year growth

- Average lifetime value (LTV) of user or customer

- Net Promoter Score (NPS)

- Number of deals lost to competition

- Percentage of sales reps attaining 100% quota

- Revenue by territory

- Revenue by market

- Cost of selling as a percentage of revenue generated

2. Activity Sales Metrics

These sales metrics show what salespeople are doing on a daily basis. Activity metrics are “manageable,” meaning sales managers can directly influence them.

Imagine one of your reps isn’t hitting her quota. Digging into her activity metrics, you discover she isn’t sending enough emails to generate the number of calls she needs. You can’t control how much this salesperson sells — but you can tell her to increase her daily email output.

Activity metrics include:

- Number of calls made

- Number of emails sent

- Number of conversations

- Number of social media interactions

- Number of meetings scheduled

- Number of demos or sales presentations

- Number of referral requests

- Number of proposals sent

Activity sales metrics are leading indicators. In other words, they predict your ultimate results.

3. Pipeline Sales Metrics

Gauge the health of your sales pipeline with these metrics. They help you understand what’s working and what’s not regarding your holistic sales process.

- Average length of sales cycle

- Total open opportunities by month/quarter (by team and by individual)

- Total closed opportunities by month/quarter (by team and by individual)

- Weighted value of pipeline by month/quarter (by team and by individual)

- Total value of sales by month/quarter (by team and by individual)

- Average contract value (ACV)

- Win rate (by team and by individual)

- Conversion rate by sales funnel stage (by team and by individual)

4. Lead Generation Sales Metrics

How well are your salespeople prospecting? Use these metrics to find out.

- Frequency/volume of new opportunities added to the pipeline

- Average lead response time

- Percentage of leads followed up with

- Percentage of leads followed up within target time range (for example, 8 hours)

- Percentage of leads dropped

- Percentage of qualified leads

- Customer acquisition cost (CAC)

5. Outreach Sales Metrics

Some metrics in this category probably won’t be important to your company. It comes back to your individual sales process, methodology, and strategy: If your reps exclusively target prospects they’ve met at trade shows, the average initial-contact-to-meeting rate would be a better reflection of their performance than average email open rate.

Email Sales Metrics

- Open rate

- Response rate

- Engagement rate (link clicks, webinar attendance, video plays, etc.)

- Percentage of recipients who move to the next step

Phone Sales Metrics

- Call-backs

- Percentage of prospects who agree to a conversation

- Percentage of prospects who move to the next step

Social Media Social Metrics

- Percentage of LinkedIn connection requests accepted

- InMail response rate

- Percentage of prospects engaged with on social media who move to next step

- Conferences, trade shows, events

- Number of meetings set

- Number of qualified opportunities generated

6. Primary Conversion Metrics

- Percentage of opportunities closed/won

- Percentage of opportunities lost (no decision)

- Percentage of opportunities lost to competitor

- Percentage of opportunities won by lead source

- Average number of conversations for won opportunities

- Average number of conversations for lost opportunities

7. Channel Sales Metrics

These metrics will help you optimize your channel sales strategy.

- Total revenue from partner deals

- Revenue by partner

- Margin by partner

- Average deal size by partner

- Number of partners achieving revenue targets

- Number of new opportunities added by partners

- Number of qualified opportunities added by partners

- Number of opportunities in partner pipeline

- Average deal velocity (number of days, weeks, or months until a deal is marked closed/won or closed/lost)

- Retention rate of partner customers

- Average cross-sell and upsell rate of partner customers

- Average customer satisfaction score of partner customers

- Total number of partners

- Number of new partners added in past month/quarter/year

- Number of partners lost in past month/quarter/year

- Average time to find, onboard, and train new partners

8. Sales Productivity Metrics

Sales productivity is defined at the rate at which your salespeople hit their revenue targets. The less time it takes a salesperson to meet her quota, the higher her sales productivity.

To see how productive your reps are, use these metrics:

- Percentage of time spent on selling activities

- Percentage of time spent on manual data entry

- Percentage of time spent creating content

- Percentage of marketing collateral used by salespeople

- Average number of sales tools used daily

- Percentage of high-quality leads followed up with

9. Rep Hiring and Onboarding Metrics

Without a solid talent management strategy, hitting your targets becomes far harder. Nothing makes team quota slip further out of reach than unexpectedly losing a high (or even average) performer.

Sales managers feel pressured to fill the role as quickly as possible, which often leads them to settle for a mediocre candidate. By relying on data to tell you when and how to recruit, you can avoid this issue.

Sales Hiring Metrics

- Percentage of sales management time spent recruiting

- Average time-to-hire

- Percentage of hires from various sources

- Percentage of offers accepted

- Average tenure with your company

- Average turnover rate

- Average cost to replace a salesperson by role

Sales Ramp

Sales ramp-up time represents the average amount of time it takes a new salesperson to become fully productive. Use it to make hiring and firing decisions, set expectations with new reps, and develop more accurate sales forecasts.

There are multiple ways to calculate it. CRMs often automatically calculate the meantime to 100% quota attainment, which you can use to set ramp. For instance, if it typically takes a salesperson four months to hit 100% quota, your ramp-up time would be four months.

Although this method is fairly simple, it ignores the fact new sales reps often take over existing accounts or prospects — which gives them a head start. In addition, a salesperson who hits 98% of their quota is likely fully ramped, but this formula wouldn’t count them as such until they hit 100%.

Alternatively, Ideal CEO Somen Mondal has developed a formula that factors in training, the length of your sales cycle, and prior experience.

Ramp-up = amount of time spent in training + average sales cycle length + X

X is based on the salesperson’s experience: The more they have, the smaller this number is. Here’s an example for a well-seasoned rep, assuming training lasts 20 days and your average sales cycle is six weeks.

Ramp = 20 days + 42 days + 16 days

This salesperson would receive 78 days to reach full productivity.

10. Sales Process, Tool, and Training Adoption Metrics

Most companies invest heavily in sales enablement and training. To ensure your money is being spent wisely, track the following metrics.

- Percentage of reps following the sales process

- Percentage of reps using sales and marketing collateral

- Percentage of reps using designated scripts, messaging, and/or email templates

- Average cost of training by salesperson

- Average time spent in training every month, quarter, and/or year by salesperson

- Percentage of reps applying sales training six months out

- Average level of satisfaction with sales training

- Percentage of reps using the CRM

- Percentage of reps using a specific tool, such as LinkedIn Navigator, Datanyze, or HubSpot Sales.

It’s relatively simple to gauge CRM and technology adoption: Simply look at your usage data. However, knowing how many reps are following your sales process is more challenging. Consider holding an anonymous survey with questions like, “Do you follow the outlined sales process with the majority of your prospects?”, “Do you use the prescribed needs assessment framework?”, and so on.

You should also use blind surveys to learn how satisfied reps are with the quality, frequency, delivery method, and focus of your sales training program.

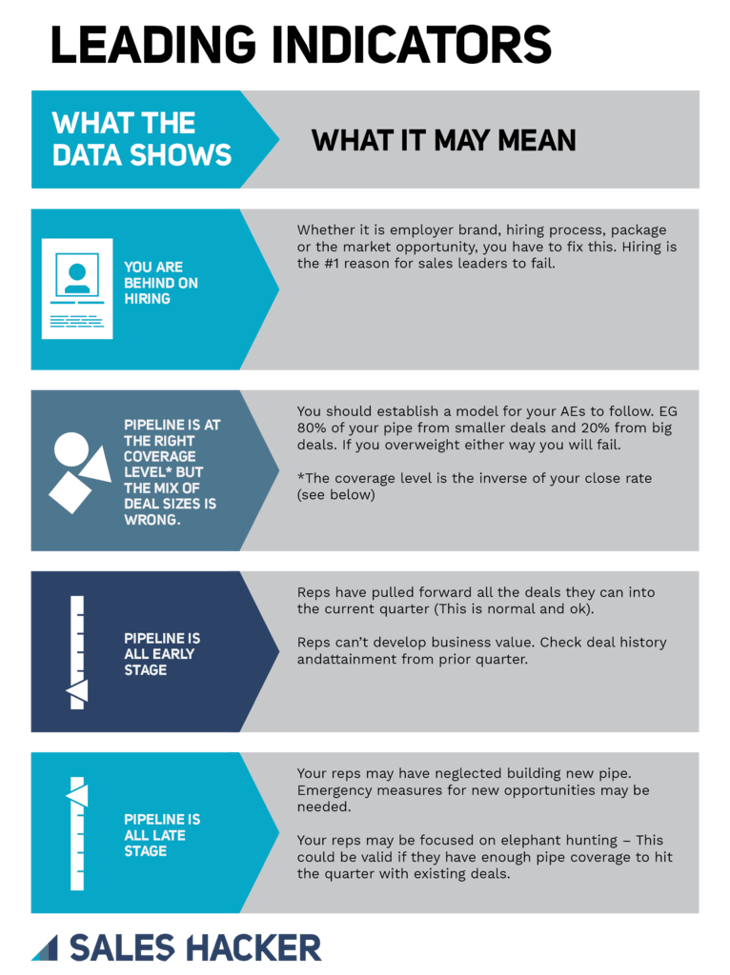

11. Leading Indicators

A leading indicator predicts your results. In other words, it tells you which direction you’re trending while there’s still time to change the final outcome. While leading indicators can be more difficult to measure than lagging indicators, they’re also far more easy to influence.

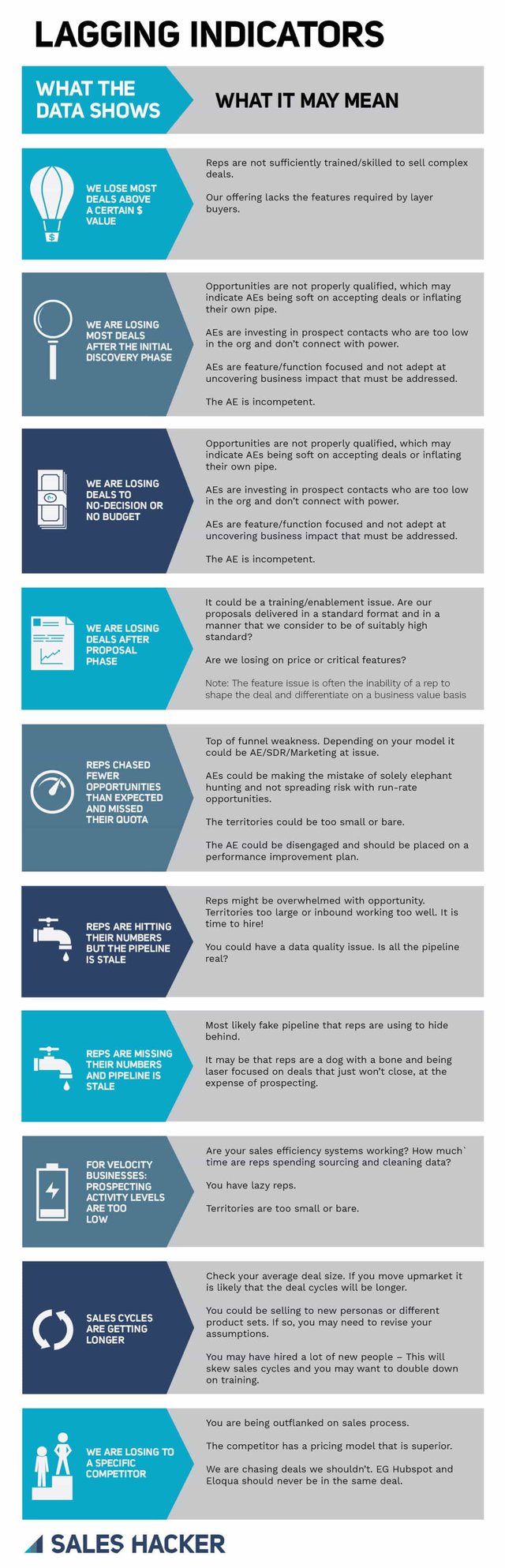

12. Lagging Indicators

A lagging indicator reflects your ultimate results.

They’re reactive, not proactive. For instance, a lagging indicator might be your team’s quota attainment at the end of the month.

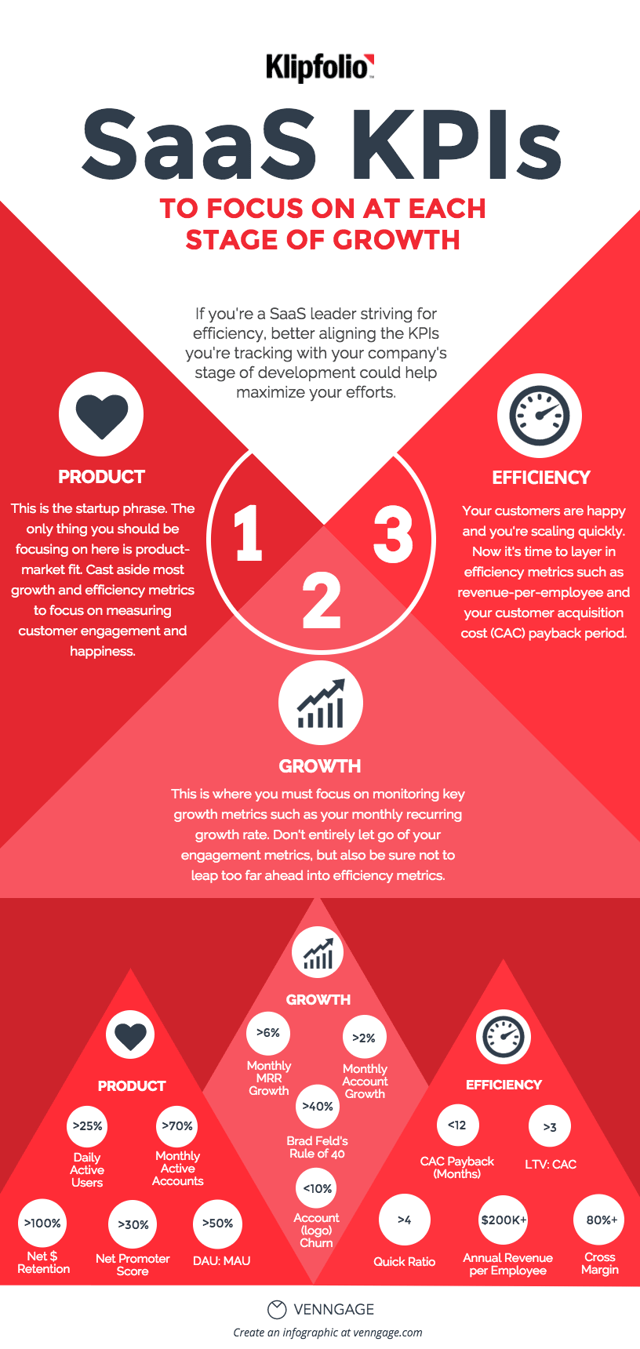

SaaS and subscription businesses require different metrics. As David Skok, general partner at Matrix Partners, explains:

SaaS and other recurring revenue businesses are different because the revenue for the service comes over an extended period of time (the customer lifetime). If a customer is happy with the service, they will stick around for a long time, and the profit that can be made from that customer will increase considerably. On the other hand if a customer is unhappy, they will churn quickly, and the business will likely lose money on the investment that they made to acquire that customer.”

Rather than solely focusing on acquiring the customer (the “first sale”), Skok explains you must also focus on keeping them (the “second sale”).

Check out the sales KPIs you should track at each stage of your startup’s growth.

Source

Source

13. SaaS Metrics

Software as a service (SaaS) is a software distribution model which provides customers with access to applications on the internet instead of requiring physical media and custom installation. Here are the SaaS metrics to measure:

Customer Acquisition Cost

Cost of customer acquisition (CAC) is the average amount of sales and marketing expenses required to acquire one new customer.

Here are some potential components of your CAC:

- Inbound marketing (blogging, SEO, social media)

- Sales and business development

- Paid advertising

- Events and trade shows

How to Calculate CAC

To calculate CAC, divide the total amount you spent on sales and marketing in a given time period by the number of customers you acquired in the same time period.

For example, if you spent $1,000 in one month and acquired 50 customers, your CAC would be 20.

This formula is easy to follow. But as HubSpot’s former VP of Growth Brian Balfour explains, it can be inaccurate unless your prospects become customers extremely quickly or your marketing and sales expenses are static (which is unlikely). If you measure CAC by month, but it takes your typical prospect two months to buy after the first marketing touchpoint, your results will be misleading. Perhaps you start a new marketing campaign in January — its impact on CAC won’t be visible until February.

To correct for these mistakes, Balfour recommends using the following formula:

Here’s the same formula written out:

CAC = (Marketing Expenses (n-60) + 1/2 Sales (n-30) + ½ Sales (n)) / New Customers (n), where n= Current Month

Cost Per Acquisition

Balfour also points out people commonly conflate “CAC” with “CPA” — but the two are different, and this mistake can be expensive.

CPA stands for Cost Per Acquisition. It represents how much money you need to spend to acquire a non-customer, like a lead, a free trial, a registration, or a user.

This means CPA and CAC are related: Your CPA is a leading indicator of your CAC.

For example, if you offer a freemium version of your software product, your CPA would measure the cost of acquiring a free user. Your CAC would measure the cost of acquiring a paid user.

Months to Recover CAC

Startups must know how many months it takes to recover CAC, (the amount they invested in getting a new customer).

Not only does this metric help you manage cash flow, it also tells you how long you need to retain a customer to break even.

Let’s say your CAC is $200, and your average revenue per account (ARPA) is $400. Your gross margin is 95%.

Months to recover CAC = CAC divided by (ARPA x GM)

In this example, you’d break even in approximately two weeks.

Customer Lifetime Value (LTV)

Customer lifetime value (LTV) is the average amount of money your company makes from a buyer for however long they stay a customer (i.e., X months or years).

LTV tells you whether you’re spending too much or too little on acquiring customers. The optimal LTV:CAC ratio is 3:1. In other words, if it takes a dollar to get a prospect to buy your product, they’ll spend $3 over their time as a customer.

Segment your customers, then look at average LTV. The findings will tell you where to focus your energy and/or change your strategy. For example, if Tier X of accounts has a 1.5:1 LTV:CAC ratio, while Tier Y has a 4:1 ratio, you’d probably want to:

- Decrease your marketing and sales expenses for Tier X and increase them for Tier Y

- Figure out why Tier X customers are less profitable — are they churning earlier, buying less, and/or purchasing fewer add-ons?

Revenue Retention

Average Revenue Per Account (ARPA) is the mean amount of revenue from a single user or customer. Companies typically calculate it per month or year, depending on their business model. If you offer monthly contracts, calculate it on a per-month basis; if the majority of your contracts are annual, calculate it per year.

Annual Revenue Per Account = total revenue generated from all customers/paying users divided by total number of customers

Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue (MRR) tracks the total predictable revenue your company expects to make each month. It’s one of the most important sales metrics for SaaS businesses, since it reflects growth and helps you forecast future revenue.

How to Calculate MRR

There are two ways to calculate MRR.

- Add up the monthly revenue you’re bringing in from each customer for total MRR.

- Multiply ARPA by your number of paying customers.

The first method takes longer but is also more accurate. If Customer X is paying $200 per month, and Customer Y is paying $400 per month, your MRR would be $600.

The second method is easier. If you have four customers, and ARPA is $150, your MRR would be $600.

Make sure you’re not including one-time payments in your MRR, like implementation and/or limited support fees.

Be careful about quarterly, semi-annual, and annual plans as well. Let’s say a new customer signs a $1,200 year-long contract in December. If you tally up your MRR on a customer-by-customer basis that month, you might incorrectly add $1,200. But you’re not generating $1,200 from this account each month — you’re generating $100.

To include these subscription values in your MRR, simply divide them by four, six, or 12 if they’re quarterly, semi-annual, or yearly, respectively.

New MRR

New MRR refers to revenue from new customers. Suppose you acquired one customer paying $50 per month and a second customer paying $45 per month. Your new MRR would equal $95 per month.

Expansion MRR

Expansion MRR is revenue generated from existing customers, including cross-sells (buying complementary products or services), upgrades/upsells (a more expensive plan), and greater volume (buying more seats, usage data, transactions, etc.)

Expansion MRR is considered the “holy grail” of MRR. Why? It’s five to 25 times less expensive to retain an existing customer than acquire a new one; plus, customers are far less likely to churn when they’ve invested more into your suite over time.

Churn MRR

Churn MRR is the revenue you’ve lost from customers who have downgraded their plans or canceled altogether. It’s a leading indicator of next month’s MRR. For example, if two customers each paying $400 canceled in June, your MRR would be $800 lower in July.

Annual Recurring Revenue

Annual recurring revenue is your MRR multiplied by 12, or the amount of recurring revenue you’ll generate in a calendar year.

It has a big advantage over MRR. Because salespeople typically sell more during longer months (like March, August, and December), and sell less during shorter months (like February, June, and April), your predicted MRR might be off from month to month.

Since ARR applies to the entire year, monthly variance has no impact.

Should You Focus on MRR or ARR?

The short answer is, you should focus on both. While MRR tells you how your business is doing on a monthly basis, ARR gives you a yearly picture.

Your priority should depend on your company’s maturity and business model. If you’re generating more than $10 million every year, think in terms of ARR. If you’re generating less than that, a shorter-term lens is more helpful.

Churn Rate in SaaS

Your churn rate is the percentage of customers who cancel their recurring subscriptions. You can calculate per month, quarter, or year, depending on the most common type of contract you use.

Churn rate = the number of customers at beginning of time period minus the number of customers at the end of time period divided by number of customers at beginning of time period.

Or put another way, the formula for churn rate is:

(# of customers lost in given time period) / # total customers at beginning of given time period

Imagine the majority of your customers are on semi-annual plans. In January, you have 400 customers. In June, you have 500 customers.

Your churn rate equals: -100 / 500, or -20%. You’re gaining more customers than you’re losing.

Revenue Churn

No matter what, churn is bad. However, revenue churn is different from customer churn. Revenue churn is the amount of revenue you’ve lost (a.k.a. churn MRR), while customer churn is the number of customers you’ve lost.

From a business standpoint, it’s probably preferable to lose three customers each paying $40 per month than one customer paying $300 per month.

Negative Churn

Negative Churn is a term popularized by Skok that means your expansion MRR exceeds your churn MRR. If you can achieve negative churn, your business will grow exponentially.

Sales KPIs by Team Type

You can also look at sales KPIs by the type of team you have — here are some examples:

1. Inside Sales KPIs

According to LevelEleven, inside sales teams rely on these KPIs (from most frequently used to least):

- Number of deals closed

- Opportunities by stage

- Calls

- Meetings

- Significant interactions or events (for example, ROI meetings or conversations lasting four-plus minutes)

- Opportunities created

- Demos

- Quotes/proposals

- Emails

- Meetings scheduled

2. Field Sales KPIs

Outside sales teams use many of the same metrics as inside sales teams but prioritize meetings more heavily.

- Meetings

- Number of deals closed

- Opportunities created

- Opportunities by stage

- Quotes/proposals

- Significant interactions or events

- Calls

- Demos

- Emails

3. Sales Development Metrics

Companies use these sales development metrics to benchmark their SDR team’s efficiency and ability to grow pipeline.

- Meetings

- Calls

- Opportunities created

- Significant interactions or events

- Opportunities by stage

- Number of deals closed (by their partner Account Executive)

- Demos

- Emails

- Meetings scheduled

1. Sales Performance by Rep

Create friendly competition by publicly tracking how each salesperson is performing. Pick your sales metrics based on the behavior you want to promote; for example, if you’re trying to increase your team’s prospecting efforts, you might display the number of total opportunities created in the last month.

To ensure your reps didn’t chase unqualified leads simply to fill their pipelines, you might also display total sales by rep.

2. Sales Activities

Keep your reps focused on the right tasks with an activities dashboard. Visualize how many days in a row they’ve logged into the CRM, how many calls they’ve made in the past week, how many presentations they’ve given, how many emails they’ve sent, and so on.

3. Sales Management

It’s critical for sales managers to know how the team is trending. Track the value of new opportunities compared to the previous month or quarter, the weighted value of your pipeline, total sales versus your target, and/or close rate by salesperson.

Sales KPI Template

If you don’t have a CRM, a KPI template gives you an easy way to track your sales metrics in a single place.

This KPI tracking spreadsheet is customizable to your business goals. It includes a step-by-step guide to choosing company-wide KPIs and tabs for selecting KPIs by employee, function, and department, respectively. In addition, the spreadsheet has pre-built formulas to help you tie your KPIs to KRAs.

Begin Using Sales Metrics to Grow Better

Some teams never track sales metrics at all. Carefully picking which ones to prioritize and then course-correcting (or even completely pivoting) as needed will put you ahead of the game — you’ll be able to analyze your progress, achieve your sales goals, and positively impact your bottom line.

![]()

Source: hubspot sales